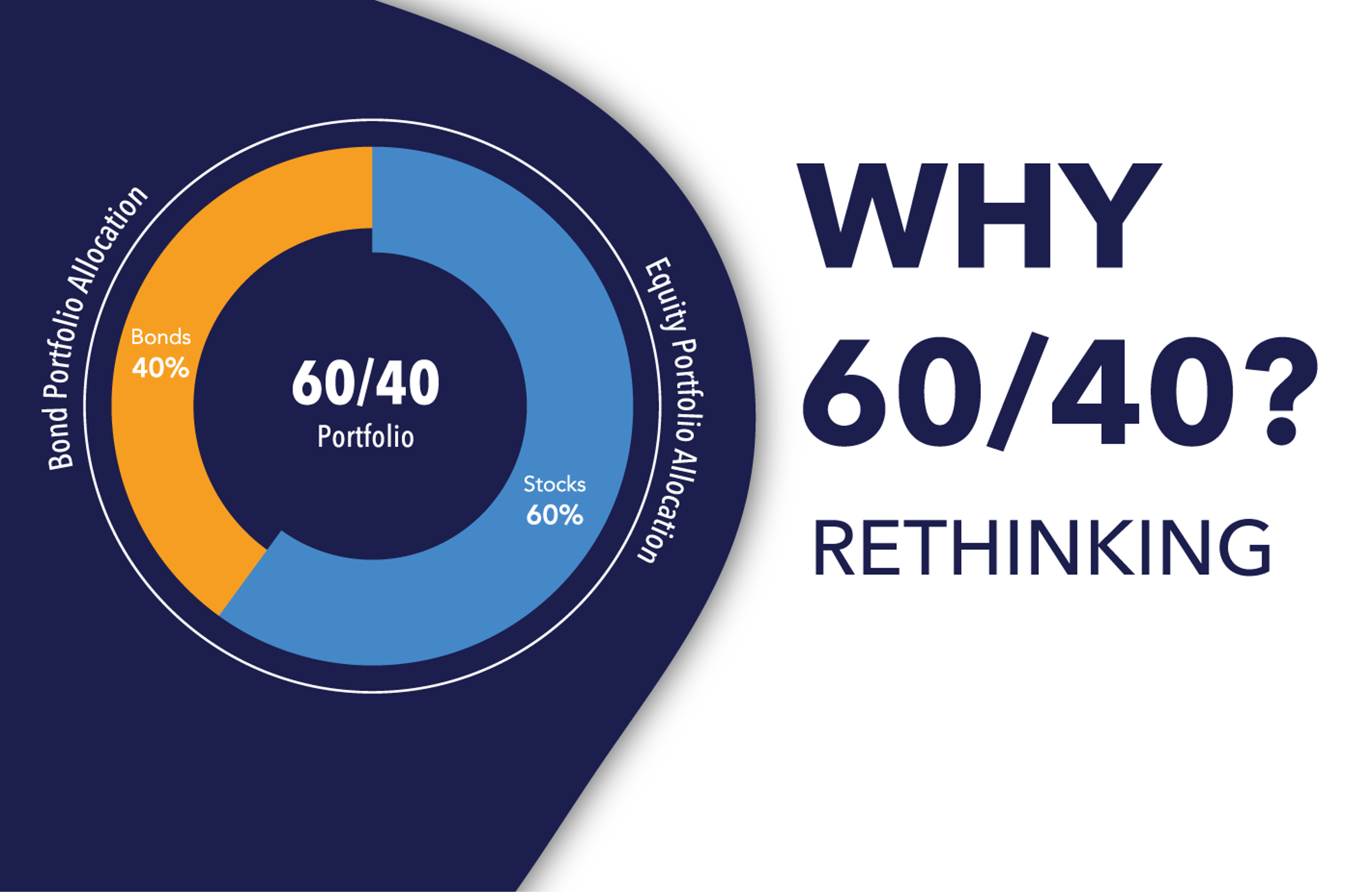

Most of people, who either don’t have time to watch the market or have no financial background, usually enroll their retirement fund in 401K account into a retirement age-based fund. For example, if the person targets to retire 20 years from now, then he will allocate his fund into a single fund such as BlackRock’s LifePath Index 2045 Fund or Vanguard’s Target Retirement 2045 Fund, which provides broad diversification through different asset mix by incrementally decreasing exposure to stocks and increasing exposure to bonds as each fund’s target retirement date approaches. The rule of thumb that financial advisors have traditionally urged investors to use, in terms of the percentage of stocks an investor should have in their portfolio, is that 100 minus your age. This formula suggests, for example, that a 30-year-old would hold 70% in stocks and 30% in bonds, while a 60-year-old would have 40% in stocks and 60% in bonds.

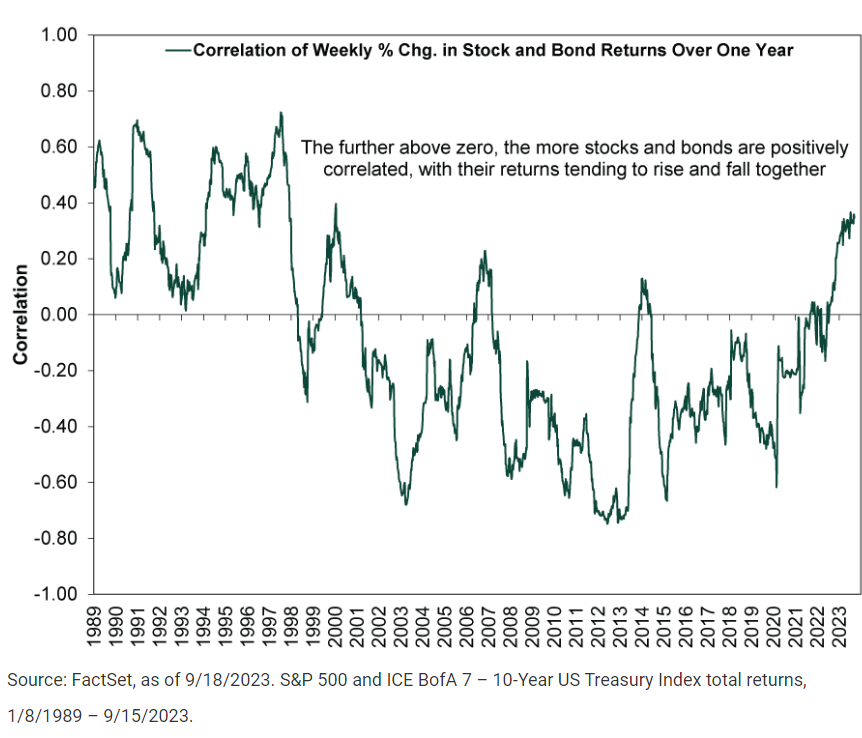

The reason to have bond exposure in the retirement portfolio is to gain the diversification as its negative correlation with stock performance will offset the loss incurred in one asset class. However, the rising inflation since 2021 changed the stock-bond correlation regime as shown in the following Exhibit. Now the bond exposure may become a drag in portfolio performance with the low 10-year average return of 2% if it loses its diversification benefit.

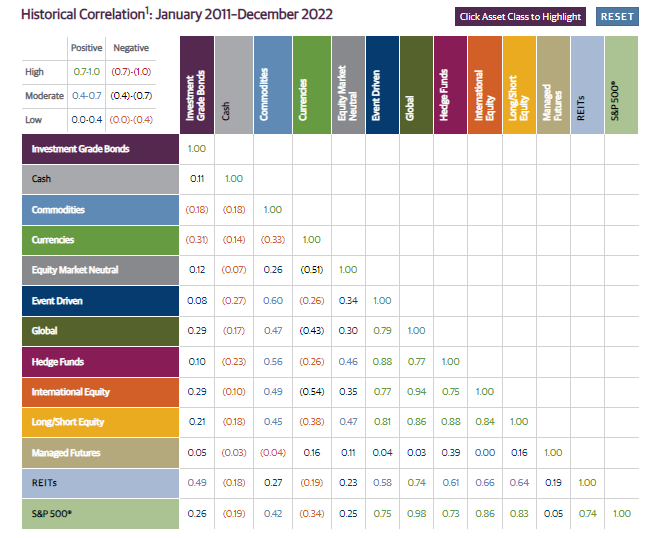

So can we simply get rid of the bond exposure from our retirement portfolio? Probably not. Specially when you’re approaching the retirement age you need to minimize the volatility of your portfolio and sequencing risk. You can replace bond exposure with some other alternative assets which are negatively correlated with the stock market in general. In the last decade U.S. Dollar Index and Cash are the only two asset classes presenting negative correlation with S&P 500 based on the following chart provided by Guggenheim Investments.

Source: Source: Calculated by Guggenheim Investments using data from Bloomberg.com and Standardandpoors.com. Performance displayed represents past performance, which is no guarantee of future results.

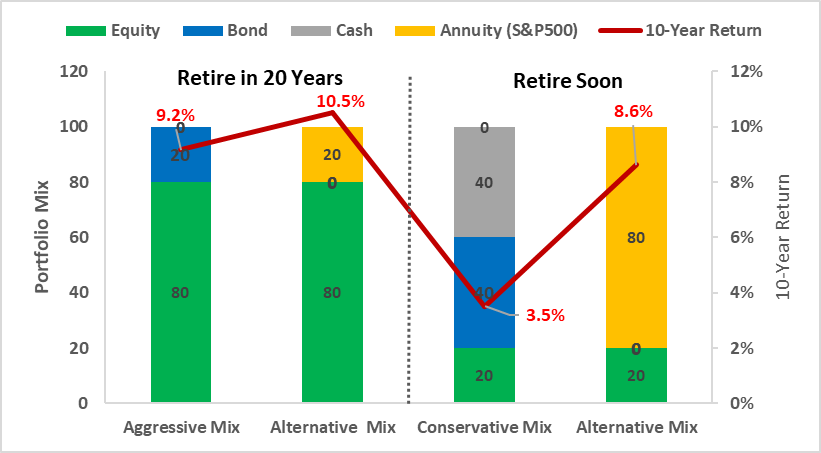

To boost the return of our retirement portfolio without introducing additional downside risk, Indexed Annuity is a good strategy to deploy and to replace the bond exposure. Based on the research of Money Wisdom Coaching, a growth driven S&P500 Index-linked annuity could provide up to 12% return with a ZERO loss and 10-year average return of 8%, which is performing much better than bond or cash exposure. As shown in the following graph, with the replacement of S&P500 linked annuity, the performance of the retirement portfolio in two different scenarios has improved from 9.2% to 10.5% and from 3.5% to 8.6% respectively.

Given the specific needs of each individual’s retirement planning and the complexity of annuities by different insurance carriers in the current market, please reach out to catherine.li@moneywidsomcoaching.com to seek advice for your asset management of retirement portfolio.